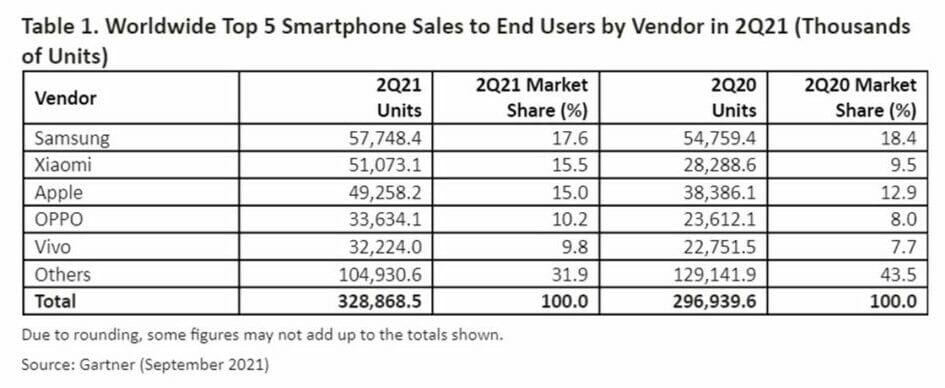

Overall, global mobile phone sales grew by 10.2%, despite supply constraints due to COVID-19-related production disruption and component shortages, according to Gartner.

Samsung maintained the No. 1 position among the top five global smartphone vendors, as the company expanded its 5G smartphone lineup at entry and midrange prices to target growth opportunities in 5G segments.

While it continues to be a market leader, Samsung’s year-on-year growth slowed due to supply constraints and production disruptions.

Elsewhere in the global smartphone market, Xiaomi moved into the No. 2 spot in Q2 2021 for the first time, while Apple dropped to No. 3.

Xiaomi registered 80.5% growth in its smartphone sales, owing to a stronger online presence and fast expansion in the global markets beyond APAC, led by investments in retail channels and partnerships with communication service providers (CSPs).

While Apple sales grew 28.3% year-on-year, its market share remained the same in comparison to the previous quarter.

The key to mobile security? Be smarter than your device

“Reinforced shelter-in-place instructions and factory shut-downs in India and Vietnam due to the second wave of COVID-19, along with closure of retail businesses and restrictions on online deliveries affected smartphone sales negatively in the second quarter after a strong start in beginning of 2021,” said Anshul Gupta, senior research director at Gartner.

“However, regions with higher penetration of 5G connectivity saw strong demand for 5G smartphones and were growth drivers for leading smartphone vendors.

“Apple’s aggressive sales promotion for its iPhone 11 series smartphones and iPhone SE (2020) added to its growth in the price-sensitive segment.”

Meanwhile, Oppo and Vivo joined fellow Chinese vendor Xiaomi in the top five, growing 42.4% and 41.6%, respectively.

Aggressively priced mid-tier smartphones, a wider distribution network and robust marketing campaigns in Western Europe boosted the growth of Oppo, while Vivo is continuing to expand beyond APAC, beginning with a focus on EMEA.

Gupta continued: “Demand for smartphones continued to be strong in this quarter as buyers preferred higher specifications and better user experience.

“The pent-up demand from 2020 continues to drive advantage for global smartphone vendors in 2021.”