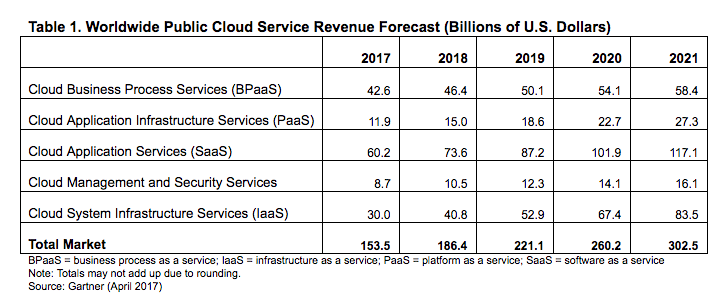

The fastest-growing segment of the market is cloud system infrastructure services (infrastructure as a service or IaaS), which is forecast to grow 35.9% in 2018 to reach $40.8 billion (see Table 1).

Gartner expects the top 10 providers to account for nearly 70% of the IaaS market by 2021, up from 50% in 2016.

“The increasing dominance of the hyperscale IaaS providers creates both enormous opportunities and challenges for end users and other market participants,” said Sid Nag, research director at Gartner.

>See also: Public cloud services revenue to reach $260BN in 2017 – Gartner

“While it enables efficiencies and cost benefits, organisations need to be cautious about IaaS providers potentially gaining unchecked influence over customers and the market. In response to multi-cloud adoption trends, organisations will increasingly demand a simpler way to move workloads, applications and data across cloud providers’ IaaS offerings without penalties.”

Software-as-a-service (SaaS) remains the largest segment of the cloud market, with revenue expected to grow 22.2% to reach $73.6 billion in 2018. Gartner expects SaaS to reach 45% of total application software spending by 2021.

“In many areas, SaaS has become the preferred delivery model,” said Nag. “Now SaaS users are increasingly demanding more purpose-built offerings engineered to deliver specific business outcomes.”

>See also: The reality of the public cloud – as good as you think?

Within the platform as a service (PaaS) category, the fastest-growing segment is database platform as a service (dbPaaS), expected to reach almost $10 billion by 2021. Hyperscale cloud providers are increasing the range of services they offer to include dbPaaS.

“Although these large vendors have different strengths, and customers generally feel comfortable that they will be able to meet their current and future needs, other dbPaaS offerings may be good choices for organisations looking to avoid lock-in,” said Nag.

Although public cloud revenue is growing more strongly t0han initially forecast, Gartner still expects growth rates to stabilise from 2018 onward, reflecting the increasingly mainstream status and maturity that public cloud services will gain within a wider IT spending mix.

N.B. This forecast excludes cloud advertising, which was removed from Gartner’s public cloud service forecast segments in 2017