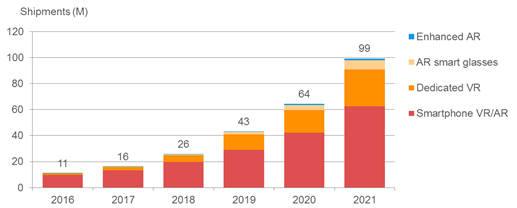

Today technology research firm CCS Insight revealed its latest forecast of virtual reality and augmented reality devices, highlighting the sector’s significant growth. Demand is growing well in this exciting technology area: CCS Insight expects 16 million VR and AR devices to be sold in 2017, a rise of 47% on the previous year.

Smartphone-based VR and AR devices continue to dominate the market thanks to their lower cost and wider availability. CCS Insight expects them to account for 13 million units of the 16 million total VR and AR devices shipped in 2017.

>See also: Digital transformation: VR and AR will revolutionise the office

Dedicated VR products, most of which come from the three biggest players — Facebook (Oculus), HTC (Vive) and Sony (PlayStation VR) — will account for 3 million units this year, rising to 5 million in 2018.

CCS Insight analyst George Jijiashvili notes: “The expected growth is encouraging progress, but it has not all been plain sailing. The three biggest makers of dedicated VR headsets all cut their prices this year in an effort to boost sales and grab a bigger slice of the market.”

The research firm highlighted the effects of Microsoft-powered headsets from companies such as Acer, Asus, Dell, HP and Lenovo as well as greater support for Google’s Daydream platform. It expects these products to provide a boost to the market in the fourth quarter of 2017 and create a strong foundation for sales in 2018.

According to CCS Insight’s forecast, VR is showing considerably more potential in the Chinese market since its forecast update in 2016. This is a result of growing interest in the technology from large Chinese companies such as Alibaba, which has offered shopping by VR, and Tencent, which is expected to launch its own VR headset. Furthermore, there are many gamers in the Chinese market who have PCs capable of supporting the new range of Microsoft-powered headsets.

Content is playing an important role. Jijiashvili continued, “So far, many people have bought VR devices for gaming, but other material, including sports, film, TV and pornography, is now playing a bigger role in the market’s growth”.

>See also: Reality bites: VR, AR and the enterprise network

The growing availability of 360-degree material is underlined by Facebook’s recent revelation that it now hosts 70 million 360-degree photos and 1 million 360-degree videos, and that the videos have generated 580 million views.

Augmented reality is another promising area identified by CCS Insight. The latest forecast provides an optimistic outlook for AR glasses. Apple’s commitment to the technology on iPhones through its ARKit platform and the advent of Google’s ARCore to Android smartphones are big factors in this. Although these platforms are only available on smartphones, CCS Insight believes that increased consumer awareness of AR they will generate will give a boost to the smart glasses market.

Jijiashvili notes, “AR experiences using a hand-held smartphone can only be a good thing for head-worn technology like AR glasses. It is only a matter of time before a big manufacturer offers a pair of smart glasses designed for consumers. We have a higher-volume scenario in the forecast based on a big company such as Amazon or Apple launching glasses. This could provide a huge lift to the segment in a similar way to Apple entering the smartwatch market”.

>See also: AR in the industrial environment: the benefits and challenges

In addition to this new consumer opportunity, CCS Insight believes that despite slower than expected growth in AR glasses for specific business uses such as warehousing and field service, there are numerous trials underway, with several companies planning to step up usage of AR glasses.

The chart below provides a snapshot of CCS Insight’s VR and AR forecast.