Tech Nation has played an important role in nurturing the innovative startups that make up the UK’s rapidly evolving tech ecosystem.

Today, the UK network for tech entrepreneurs, has released its annual report, which suggests the UK is leading Europe in scaleup investment and most of the rest of the world.

According to RocketSpace, a scaleup is a company that has already validated its product within the marketplace and has proven that the unit economics are sustainable — typically, within the technology sector

But, what are the drivers that underpin and power the economic growth within this sector?

UK tech expanding faster than the rest of the economy

Investment

According to Tech Nation, the UK tech sector performed particularly well in investment last year.

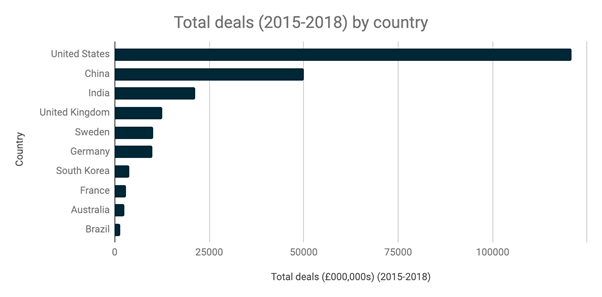

In 2018, the UK managed to attract 5% of global high-tech scaleup investment, placing it fourth in the world — ahead of Germany, France and Sweden (see Figure 1).

Investment for UK high-growth digital tech firms also grew 61% between 2017 and 2018 — driven in large part by ambitious UK tech scaleups (tech scaleups delivered the majority of all tech investments in the UK in 2018 — £5 billion of £6.3 billion).

FinTech is leading the way as the UK’s strongest tech sub-sector, where it currently ranks as number one in the world. Investment in UK high-growth fintech firms reached £4.5 billion between 2015 and 2018.

Unsurprisingly, London continues to remain the UK’s leader in attracting high-growth tech investment, receiving £9 billion from 2015 to 2018. Cambridge is second, at £583 million, and other UK cities are continuing to make considerable ground.

What are the biggest tech hubs in the UK – and which is right for your business?

UK Secretary of State for Digital, Culture, Media and Sport, Rt Hon Jeremy Wright MP, commented: “This report confirms the UK is one of the world’s leading digital economies, with some of the best minds globally working here and strong investment in the tech sector right across the country. We are working hard to continue this success and remain committed to making Britain the best place to start and grow a digital business.”

Distributed investment

Looking beyond high-growth tech companies, the last 12 years have seen a much greater distribution of investment across the UK.

According to the report, the East of England has seen the greatest increase in capital invested across all tech companies, at 206%, followed by the West Midlands (54%) and Yorkshire and the Humber (51%).

On an international scale, UK cities continue to attract investment on the global stage — despite… Brexit.

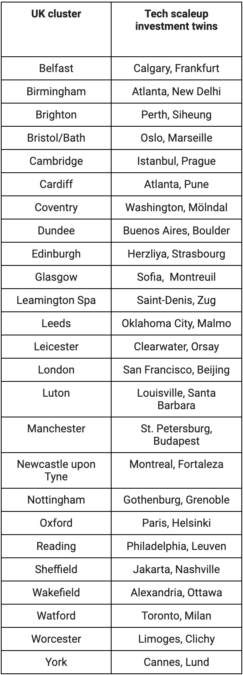

The table below shows international hubs with shared scaleup investment patterns.

Commenting on this distributed investment, Sabby Gill, managing director UK & Ireland at Sage, said:

“Today’s Tech Nation report is yet more evidence the digital sector in Newcastle is thriving. When looking at the growth rate for e-commerce and AI technologies, Newcastle is placed in the top five global cities, outperforming other UK and international hubs. There is significant momentum for the business community in our region, which will no doubt be added to with devolution to the North of Tyne and our newly elected Mayor now in post.

“The next step for our region is to replicate this success across our key sectors in the North of Tyne…Despite continuing to lead in global tech investment and growth, the UK as a whole underperforms global peers on productivity. We want to see as many of our small businesses given the opportunity to grow alongside those in the wider tech sector — which means going digital and boosting exports to deliver productivity gains.”

• Scaleup tech investment 2.5x higher than expected based on the relative size of the UK economy in 2018

• UK leads Europe and fourth in the world for scaleup investment after US, China and India

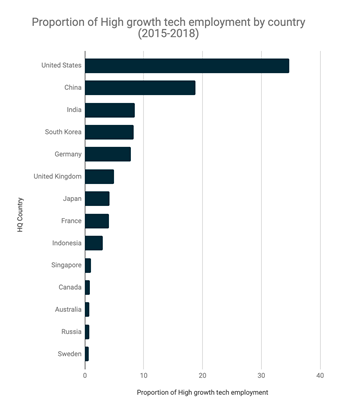

• UK remains hotbed for tech talent – employing 5% of all high-growth tech workers globally – placing the UK ahead of Japan, France and Indonesia

• To date, 35% of Europe and Israel’s tech unicorns ($1 billion valued businesses) have been created in the UK

• UK number one in the world for scaleup investment into fintech firms – generating £4.5 billion in funding between 2015 and 2018

Employment

In 2018 the UK continued to attract a significant array of tech talent, employing 5% of all high-growth tech workers globally. This places the UK ahead of Japan, France and Indonesia (see Figure 3).

In the UK, Insurtech and Fintech were the biggest employers among high-growth digital tech firms in 2018, employing 24% and 18% of the high-growth workforce respectively.

The report’s findings also identified Cyber, AI, and Cleantech as steady features in the the top ten sectors for employment in high-growth tech firms.

Investment data shows that AI, Cyber and Big Data are growing in importance for UK tech scaleups, which suggests that the UK may be about to see more jobs generated in these sectors.

Interestingly, following research from LinkedIn, this might provide more opportunities for UK workers, rather than foreign talent, as UK firms look to employ ‘locally’.

Growth

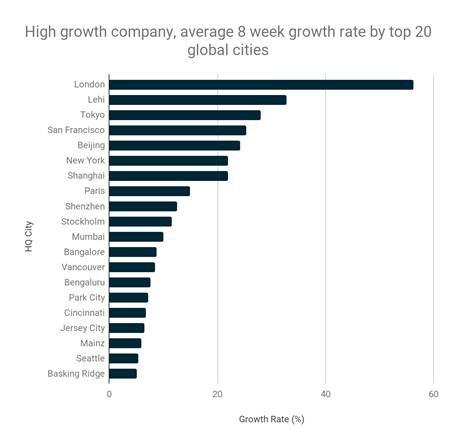

From December 2018 to February 2019, high growth firms in London grew by over 56%, more than anywhere else in the world (see Figure 4).

This confirms, according to Eileen Burbidge, partner, Passion Capital and chair of Tech Nation, that the “UK has an incredibly pivotal role in the global tech scene. Nowhere is this more evident than in the Fintech sector where the UK is ranked number one in the world; an enviable position that has been established with decades of hard work, entrepreneurial talent, innovation and supportive policymakers. I’m confident that we have all the ingredients needed for continued success and even greater acceleration of the tech sector here in the UK.”

UK tech sector leads Europe in AI — but what about the rest of the world?

Innovation

R&D expenditure in the UK in 2016 represented 1.67% of gross domestic product (GDP).

Understanding the value of tech, businesses and government have put significant financial resources towards the development of a knowledge-based economy.

Based on the most recent data from 2016, the UK was ranked 7th globally for R&D expenditure, with spending up £1.4 billion to £33.1 billion, an increase of 4.3%.

This is above the long-term annual average increase of 4.1% since 1990, according to Tech Nation.

Scaleup view

Tugce Bulut, CEO and founder, Streetbees said: “As a scaling company that embodies many of the trends within this report, I’m delighted that our research in it illustrates the UK tech sector’s diverse strengths – from the supportive ecosystem and culture, to the deep expertise in AI, fintech, e-commerce, and elsewhere – so categorically. The UK is an incredible place not only for founding a start-up, but also for growing it into a company capable of taking on the world.”

Hayden Wood, CEO and co-founder, Bulb commented: “The UK is a great place to build a technology company. We wouldn’t have been able to use tech to reinvent energy without the access we get in the UK to talent, investment and community. We’re also proud to be part of a growing number of companies developing tech for good. We’re excited to see how investment at this scale can accelerate the growth of these companies.”