UK banks HSBC and RBS, and their respective subsidiaries First Direct and NatWest, have all suffered IT-related service outages over the last few days.

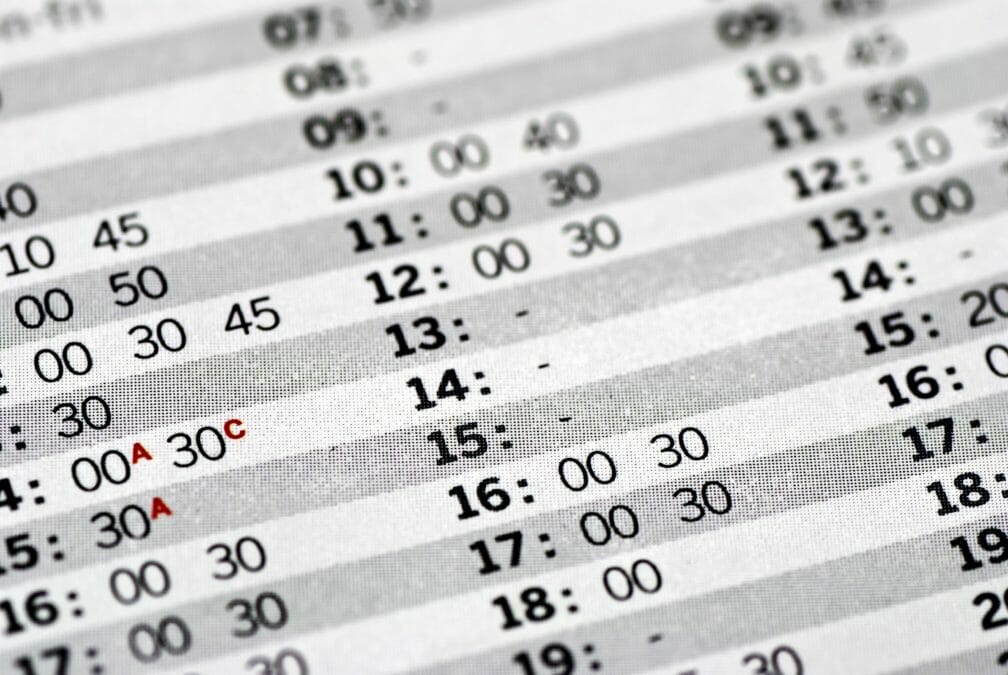

HSBC customers were unable to cash machines or online banking services for around two hours on Friday afternoon. The bank attributed the disruption to a "mainframe outage". The outage reportedly also affected customers of FirstDirect, which is owned by HSBC.

The outage, which began at around 3pm caused a backlog in payments. HSBC said that backlog had been processed by 6:20pm.

The following day, online, mobile and telephone banking services from the Royal Bank of Scotland and its subsidiary NatWest were unavailable for a few hours. RBS said the outage was caused by routine maintenance.

"There have been problems affecting online and telephone banking but we have a good understanding of the issues and are making good progress with our recovery plans," it said in a statement.

The UK’s banking sector is especially reliant on legacy, often mainframe-based IT infrastructure, with many core banking applications running on decades-old platforms.

There are signs that this may be limiting the ability of UK banks to adapt to new market and regulatory conditions.

Last month, the financial services arm of retail giant Tesco announced that the ongoing project to migrate off former joint-venture partner RBS’ legacy IT systems would take longer than expected, after glitches over the summer took down its online banking services.

Tesco Bank said the delays would cost the company £40 million – around half its yearly trading profit – in extra maintenance and postponed product launches.