The Chancellor of the Exchequer, Rishi Sunak, has announced a £330 billion package of support for businesses, equivalent to 15% of GDP.

What does this stimulus package mean for UK tech businesses. And, what does the delay to IR35 mean for employees, agencies and IT contractors?

UK tech enterprises

Unlike other industries, such as hospitality and retail, large UK technology companies will not be as severely impacted by coronavirus, as their equivalents in other sectors.

This is because they do not require a steady stream of ‘consumers’. Instead, they produce ERP, CRM or cyber security solutions, for example, that can be integrated into systems online.

“Tech firms are typically more agile, especially cloud-based solutions that are designed to expand and contract according to the needs of the buyer,” explains Tom Pressley, VP International Marketing at Everbridge.

Businesses like Amazon are actually thriving. It recently announced plans to hire 100,000 more workers and give raises to current staff to deal with coronavirus demands.

The largest B2B tech enterprises will have long-term contracts in place, although ‘new business’ might be impacted.

Perhaps this is why, currently, the government has not announced measures impacting large tech enterprises.

Although, the Prime Minister Boris Johnson has urged the top UK tech firms to join the coronavirus fight, in what has been called the ‘digital Dunkirk’.

The impact of the coronavirus on the UK tech sector: disruption ahead?

UK tech SMEs

For UK (tech) SMEs, the situation is slightly different. These businesses rely more heavily on new business development, and a restriction on travel or face-to-face meetings, may significantly impact revenue and growth.

To combat this, the following announcements were made:

• The government will extend the Coronavirus Business Interruption Loan scheme from up to £1.2 million per business to £5 million, with no interest payable for six months. This new loan scheme will be up-and-running by the end of next week. “Any business that needs access to cash will be able to get a government-backed credit on attractive terms,” said Sunak.

• Government will increase £3,000 cash grant announced in the Budget to up to £10,000 per business. This scheme will be administered by local authorities and the business department will be talking to local authorities this week about how the scheme will work. This is a £20 billion package for local authorities. Sunak advised any small businesses in distress to speak directly to their local authorities.

• The Treasury will stand behind those businesses that do have business interruption insurance policies that do include pandemics, but will have excluded Covid-19 because it is such a new virus. However, most small businesses will still not be insured through business interruption policies because most just apply to fire and flood.

Sunak said: “This struggle won’t be overcome by a single package of measures. We will support jobs, income, businesses…we will do whatever it takes.”

“We have never, in peacetime, faced an economic fight like this one,” he added.

Reacting to the Treasury package for small business, Emma Jones, founder of Enterprise Nation, said: “Direct cash grants will provide a helpful amount of cover, helping small businesses to even out their budgeting and making room for them to continue to honour their payroll responsibilities to staff. It’s good news for the small retail and hospitality industries in particular with premises, which will get cash they don’t have to re-pay. It will delay at the very least, difficult decisions.

“What we don’t want to see is for businesses that would not otherwise survive being artificially propped up based on debt such as the new Business Interruption Loan. I wonder if this might have been better if we’d done what France announced around longer terms to pay tax and certain bills.“It’s a shame there was nothing on insurance for the self-employed or sole traders that are losing contracts with no financial support whatsoever.”

Mike Cherry, national chairman of the Federation of Small Businesses, said: “Clearly small employers will need a huge amount of support to keep staff on their books at this hugely difficult time, so it was good to hear the chancellor pledging to develop an Employment Support Package to help make that possible. We will be working together with the government to ensure the employment package provides for the self-employed.”

A remote working guide: how can UK businesses prepare for an Italy-style Covid-19 lockdown?

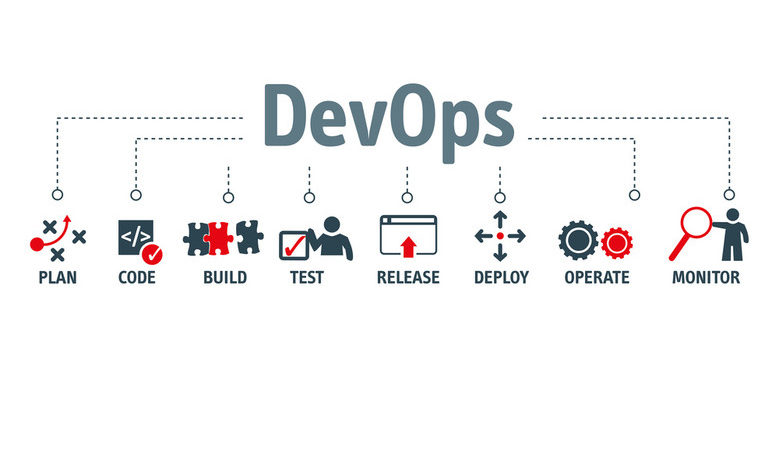

IT contractors: keep preparing for off-payroll rules

Many technology businesses, both small, medium and large, employ IT contractors.

Stephen Barclay MP, Chief Secretary to the Treasury, announced yesterday that the government will postpone the off-payroll reforms due to be implemented on 6th April 2020.

This announcement will come as a welcome relief for those individuals, agencies and contractors, although it may have come to late. “Many businesses will have already implemented their IR35 strategy and and a significant number of contractors have already had contracts terminated,” commented Claire Brook, Employment Law Partner at Legal 500-listed law firm Aaron & Partners.

Even despite the delay to IR35, it is advisable to keep preparing for off-payroll rules. Niche contractor insurance broker and employment status specialist Larsen Howie suggests that contractors, recruiters and employers not to halt plans to prepare for changes.

Andy Vessey, head of Tax at Larsen Howie, says that now, “anyone who has received an ‘inside-IR35’ status determination, having previously self-assessed themselves as outside and which HMRC may have now caught wind of, may now find the Revenue using this time to target them over the next 12 months.

“We may well also see HMRC IR35 compliance activity ramped up in 2020/21 because of the fact that anticipated PAYE & NIC receipts arising out of the operation of the off-payroll rules will need to be recovered elsewhere. IT contractors should therefore ensure they work with end-clients and recruiters to change their working practices, have tax fee protection or, even better, tax loss insurance in place for such an eventuality.

“End clients and recruiters should certainly not take their foot off the pedal but maintain their momentum to be well prepared for the inevitable on 6th April 2021, working to embed new tools and working practices across the entire supply chain.”

[emailsignup]