Before we consider the five technologies that are set to transform Fintech, consider what Fintech is.

Fintech is the synthesis of technology and finance and the harmonic combination of two of the largest industries into a single field. Naturally, its impact is enormous. Regarded as cutting-edge innovations a few years ago, now Fintech solutions are a daily reality.

According to McKinsey, 80% of traditional financial institutions were exploring innovations in 2018.

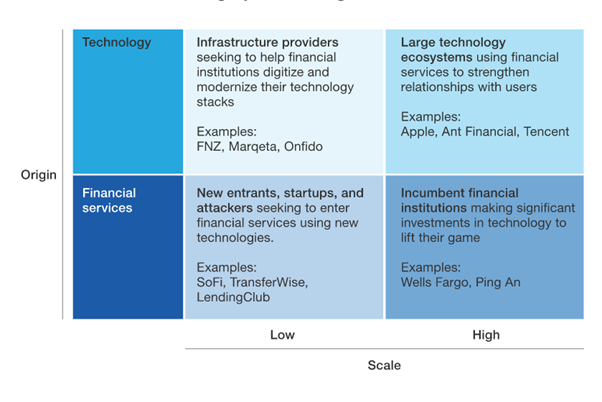

Main users of fintech, according to McKinsey

Fast forward a few years, and Fintech-powered challenger banks and neo banks, such as Monzo and Starling Bank, are very much mainstream alternatives that are using innovative technologies to improve customer experience and security.

Technologies that will transform the Fintech sector

We have analysed new Fintech projects, startups, and in-house innovations, and summarised this research in a list of top five technologies that will revolutionise the industry.

Zeta expanding into UK and beyond as CEO looks to tap into global appetite for Fintech

1. The growing number of RegTech solutions

Regulatory technology is benefiting from recent groundbreaking Fintech software innovations, creating automated solutions to manage regulation monitoring, compliance, and reporting. Keeping track of new restrictions in a single database is a comfortable way of adopting a financial institution to legal requirements.

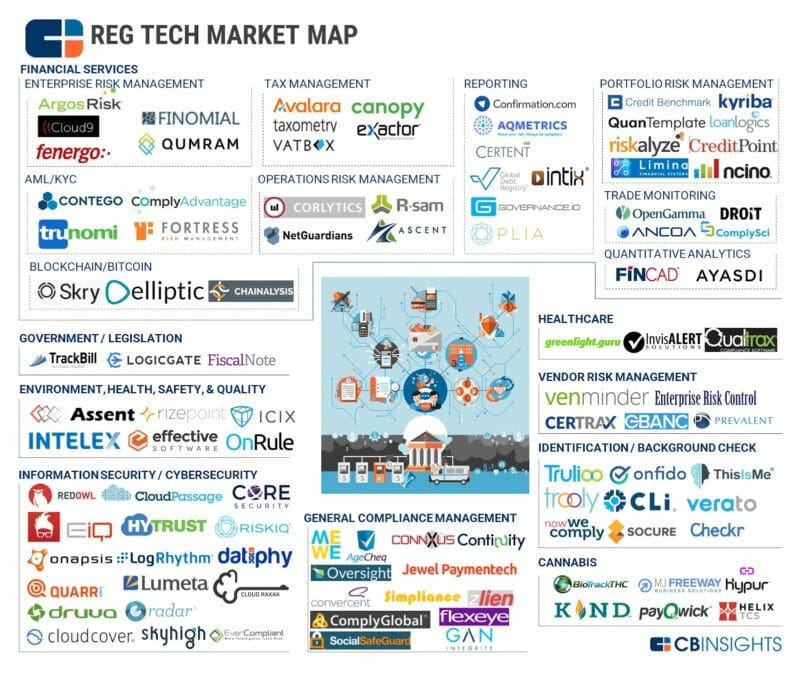

Global RegTech providers in various industries.

Benefits of RegTech

- cheap, fast, and simple control of vast data quantities;

- a precise automated search of a particular regulation;

- quick pre- and post-trade compliance;

- connecting financial institutions, regulators, and consumers, protecting the interests of all three parties.

RegTech innovations

- cooperation between financial institutions and regulatory organisations to facilitate RegTech development;

- government and financial organisations share their expertise in common projects, eliminating the skills gap. For instance, the Monetary Authority of Singapore (MAS) and Financial Conduct Authority (FCA) have been providing banks with assistance in creating automated regulatory solutions. From here, similar practices are likely to develop all over the world.

At the moment, there are over 150 RegTech companies. Compared to over 300 million pages of existing regulations, this feels like a small number. Non-compliance with mandatory governmental regulations leads to fines and crisis. The management of financial institutions (FI) should do everything in their power to avoid such problems.

The need for RegTech solutions on the market is evident. It’s evident that this niche will soon continue to be filled, with more startups emerging. This is why FI owners should consider becoming one of the primary RegTech providers in your financial sector.

Why it’s Fintechs’ duty to fight for financial fairness

2. Embracing Artificial Intelligence, Machine Learning, and Internet of Things

Artificial Intelligence (AI) has been surrounding Fintech for several years now. However, while it speaks volumes about its popularity, the efficiency is still questioned by many. Let’s take a closer look at the dynamics of AI-powered solutions in the industry, and analyse how to approach this innovation.

- Standalone AI solutions have not shown groundbreaking progress, and so far have not fulfil expectations. However, this cannot be said for smaller AI applications. Banking solutions successfully use AI for modeling techniques and analytics management.

- AI holds a lot of unexplored potentials that keeps attracting investors. There is still a lot of room for never-done-before innovation.

- Artificial Intelligence in Fintech works best with the combination of big data and management solutions. AI analyses the performance of a financial institution, creates insights, and automates essential organisational processes (team administration, documentation, client communication).

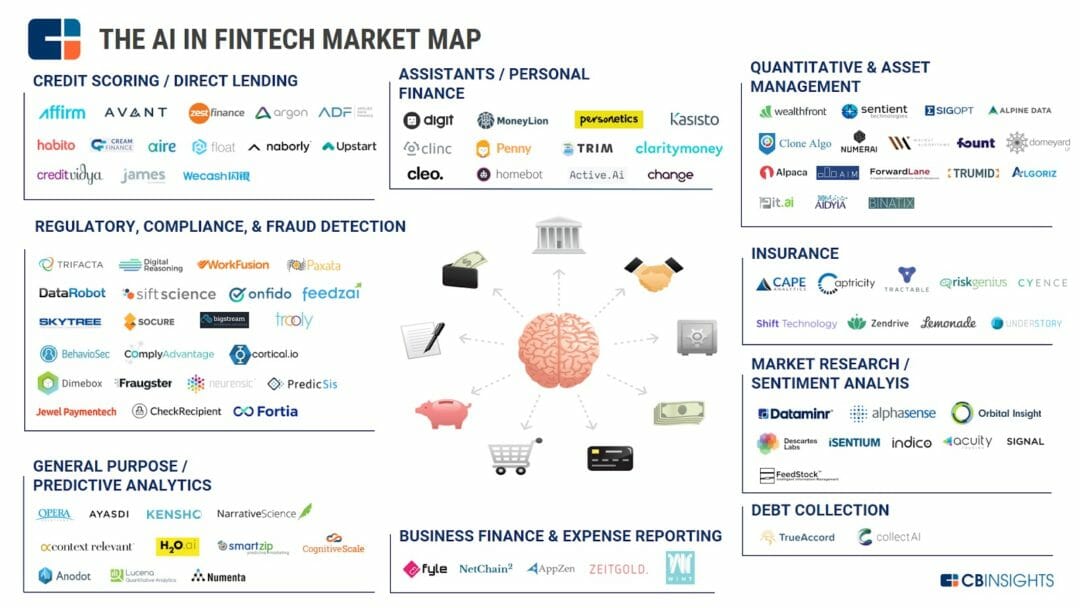

AI providers and its fields of application in the fintech industry.

A great example of AI application in the financial sector is an Alpaca Forecast AI Prediction Matrix , a price-forecasting solution, developed by Bloomberg. The software is capable of processing millions of deal records, record demand movements, define patterns, and predict future price changes.

Machine Learning (ML), one of the key AI components, is widely used in banking in the following areas:

1. Fraud prevention – ML tools analyse existing fraudulent cases, detect common, patterns, and evaluate whether a particular business doesn’t display similar behaviour. This allows us to predict possible frauds and uncover questionable financial institutions.

2. Risk management – the software analyses the company’s performance and detects potentially threatening patters;

3. Fund development prediction – by scanning investment records, an ML-powered tool can define the most probable future developments.

4. Customer service – the platform analyses customer data and builds a smart client profile.

Internet of Things (IoT), meanwhile, increases the speed of financial processes, both internally (management and team organisation) and externally (client management and communication). With an IoT network, it’s possible to connect smartphones to financial databases and send data directly from one device to another.

Retail banking is, so far, the branch that displays the progress of Fintech IoT most clearly. A great example of such innovations is CitiBank and its beacon-based solution for unlocking ATM-entrances with smartphones during off-time.

Related: Using AI to fight money laundering — Martin Rehak, founder and CEO of Resistant AI, discusses how artificial intelligence (AI) can lend itself towards the fight against money laundering.

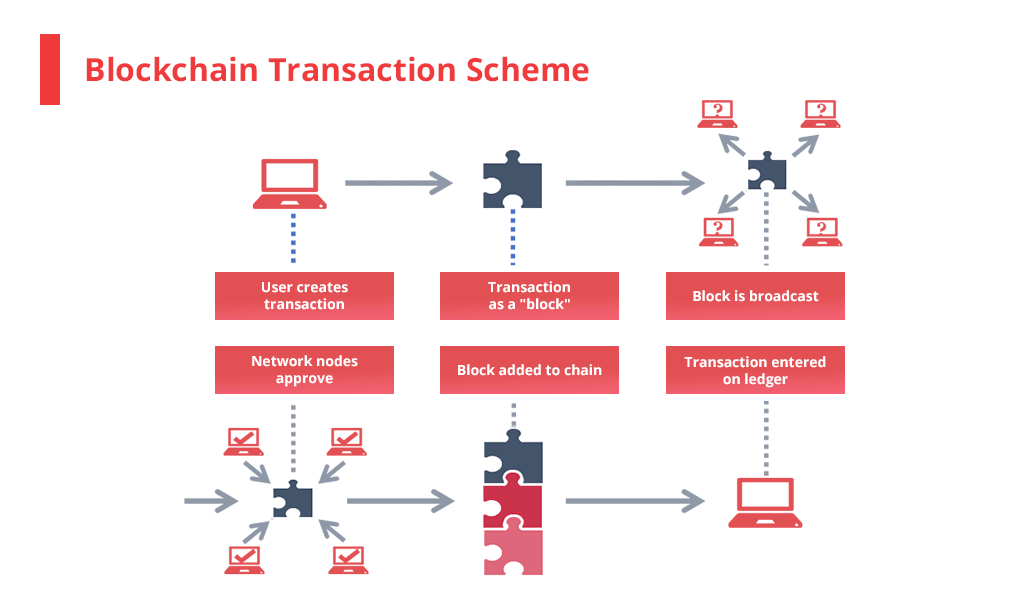

3. Blockchain is shaking things up

Blockchain has been on its rise from 2018, and while it doesn’t make headlines that often now, the innovation isn’t going anywhere. Many Asia-based banks have already officially adopted blockchain to secure financial transactions, with European and American institutions likely follow the trend.

This is how a blockchain transaction works.

Benefits of using blockchain in Fintech

- Each transaction is encrypted, with no penetration possibilities.

- Each network stakeholder had to approve the transaction which makes a hacking attack very unlikely.

- Tokenisation helps international businesses to use universal currencies instead of country-specific money.

Blockchain transactions have been implemented all over the world, from the Commonwealth Bank of Australia to Alfa Bank in Russia, and new institutions join the trend each month.

Related: Blockchain technology in financial services — This article will explore the most valuable business use cases for blockchain technology in the financial services sector.

4. Robotic process automation will orchestrate workflows

To reduce the amount of used human resources, financial institutions can apply RPA to their business management solutions. RPA uses robotics to complete the task via a Graphical User Interface (GUI). The work ranges from simple actions (selecting items, sending emails) to complex procedures (creating a report, organising a database).

The most common RPA procedures are:

- collecting statistics;

- calculating numeric values on the company’s performance and managing transactions;

- extracting summaries from large documents;

- managing regulatory documentation;

- controlling emails and attachments.

Conversational banking will become mainstream. Developments in AI and language processing technologies naturally lead to active implementation of chatbots, and Fintech is no exception. The usage of chatbots in financial management and transactions is called conversational banking.

5. How can conversational banking be used in finances in 2020?

- Responding to the client’s most asked questions. How do I find the closest ATM, how to regain access to the lost card, how do I know my password – these requests can and should be processed automatically.

- Account management: chatbots can walk clients through the process of registration, making a transaction, even taking a loan.

- Financial management: chatbots can become pocket financial advisers and keep track of budgeting, money streams, taxes.

An example of efficient conversation banking is the case of Erica, the chatbot, developed by The Bank of America. The bot processes text and voice messages and provides answers with text replies or voice memos, handling the most popular clients’ issues.

Bottom line

With the growth of technologies and ever-changing demands of financial markets, the changes are inevitable, and each year transforms Fintech in a new way. The way that those trends are incorporated into businesses is what determines companies’ success. Combining RegTech, Artificial Intelligence, Internet of Things, and Machine Learning with blockchain and conversational banking will play a crucial role in attracting customers and increasing the efficiency of the financial institutions. Banking enterprises are not required to work on each of these technologies simultaneously — this would require massive investments and tech expertise. Only by implementing several of these innovations into regular operations can they see the desired results.

Written by Alexey Kutsenko, chief marketing officer at DDI Development

You can find your next career move over at the Information Age Job Board