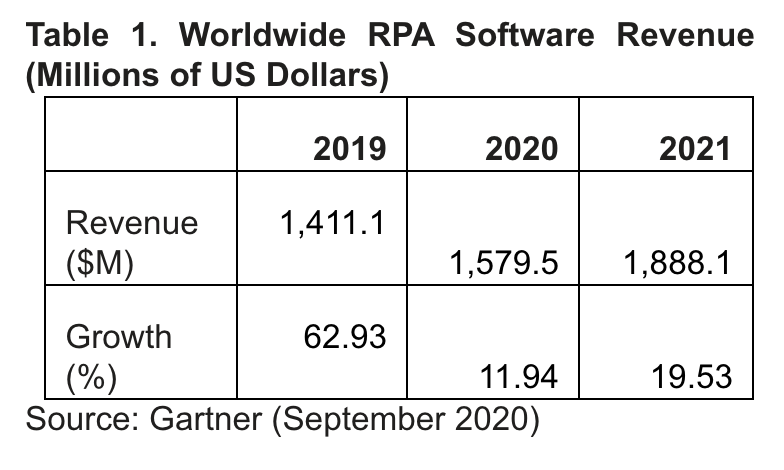

Global RPA revenue is projected to reach $1.89 billion in 2021, an increase of 19.5% from 2020, according to the latest forecast from Gartner.

Despite economic pressures caused by the Covid-19 pandemic, the RPA market is still expected to grow at double-digit rates through 2024.

“The key driver for RPA projects is their ability to improve process quality, speed and productivity, each of which is increasingly important as organisations try to meet the demands of cost reduction during Covid-19,” said Fabrizio Biscotti, research vice president at Gartner.

“Businesses can quickly make headway on their digital optimisation initiatives by investing in RPA software, and the trend isn’t going away anytime soon.”

In 2020, RPA revenue is expected to reach $1.58 billion, an increase of 11.9% from 2019 (see Table 1). Through 2020, average RPA prices are expected to decrease 10% to 15%, with annual 5% to 10% decreases expected in 2021 and 2022, creating strong downward pricing pressure.

7 key RPA trends for 2020: from AI enabler to more strategic scaling

Enterprise interest in RPA catalysed by Covid-19

The pandemic and resulting economic damage increased interest in RPA for many organisations.

Gartner predicts that 90% of large organisations globally will have adopted RPA in some form by 2022 as they look to digitally empower critical business processes through resilience and scalability, while recalibrating human labour and manual effort.

“Gartner anticipates RPA demand to grow and service providers to more consistently push RPA solutions to their clients because of the impact of Covid-19,” commented Cathy Tornbohm, distinguished research vice president at Gartner.

“The decreased dependency on a human workforce for routine, digital processes will be more attractive to end users not only for cost reduction benefits, but also for insuring their business against future impacts like this pandemic.”

RPA capacity growth

Large organisations will triple the capacity of their existing RPA portfolios through to 2024.

Gartner says the majority of “new” spend will come from large organisations that are purchasing new add-on capacity from their original vendor or partners within the ecosystem.

“As organisations grow, they will need to add licenses to run RPA software on additional servers and add additional cores to handle the load,” added Biscotti. “This trend is a natural reflection of the increasing demands being placed on an organisation’s ‘everywhere’ infrastructure.”

Future RPA clients will come from non-IT buyers

By 2024, Gartner predicts nearly half of all new RPA clients will come from business buyers who are outside the IT organisation.

“Leading RPA software vendors have successfully targeted chief financial officers (CFOs) and chief operating officers (COOs), instead of IT alone. They like the quick deployment of low-code/no-code automation. The challenge they have is integrating RPA successfully across heterogeneous, changing environments, which is where IT coordination can make the difference,” added Biscotti.