Banking research from NTT DATA has revealed that the majority (61 per cent) of banks are opting to build their own technology stack rather than buying existing solutions

With corporate demands across the financial services sector continuing to grow and evolve, banks are having to continuously innovate to keep up with customer expectations.

To respond, most institutions are choosing to take matters into their own hands, utilising in-house tech talent.

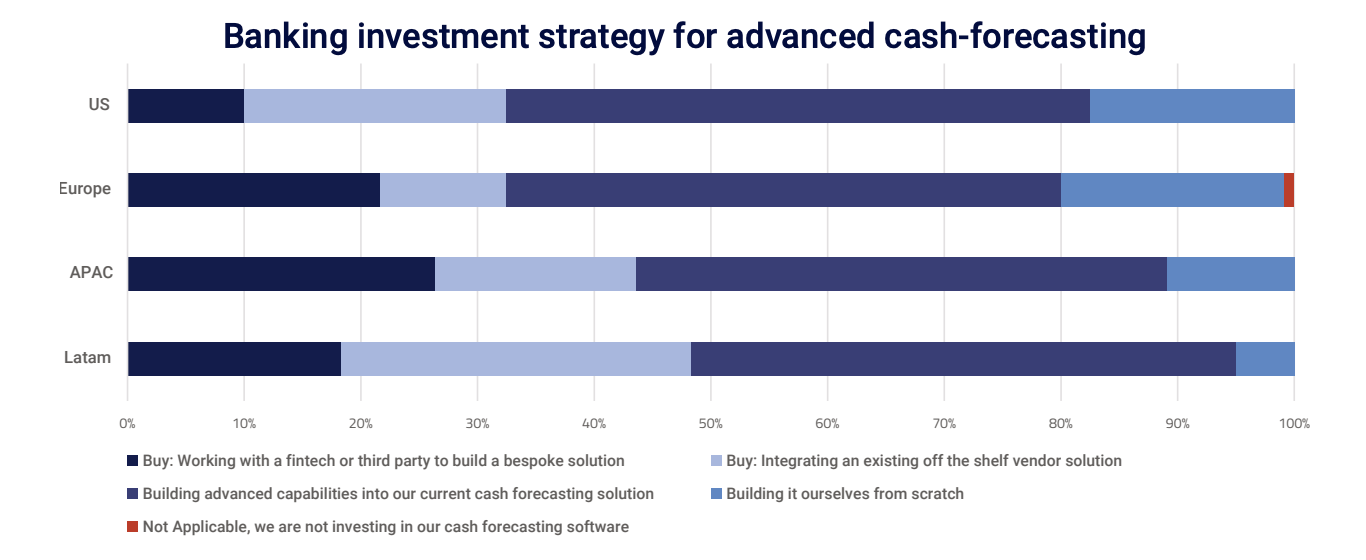

While the majority of banks are electing to build their own solutions to meet client demands, only 22 per cent are building their solutions from scratch, and 78 per cent are building upon their current cash forecasting solution.

Out of the participating banks electing to invest in tech solutions, 54 per cent are planning to work with fintech or a third-party provider, whilst 46 per cent are integrating an off-the-shelf solution.

The ‘build versus buy‘ debate is proving heated for banking institutions globally; in Europe, the preferred option is to build in-house solutions for advanced cash forecasting — matching global trends — while over a third are looking to fintech providers to support their technology offerings.

Conversely, in LATAM, there is more willingness to trust external providers, with almost half (48 per cent) of banks preferring to buy in a cash forecasting solution.

“There’s a tech stack demand that’s building for banks, and change is being demanded by their clients. The conundrum is whether banks build their own tech, or buy it in,” said Miguel Mas Palacios, director of global corporate banking at NTT DATA.

“We’re seeing the speed of corporate banking is accelerating, and the pace of technology change is increasing too. Banks are investing in new technologies such as AI and automation, all driven by customer demand.”

NTT DATA’s Global Research into Corporate Banking’s Future 2022 collated data from 900 senior decision-makers working in corporate banking, across 12 countries.

Related:

Bank IT compliance: how financial services can stay compliant with regulations — Exploring strategies that can help financial organisations stay on the right side of the law, meeting regulations and industry-adopted standards.

Blockchain technology in financial services — This article will explore the most valuable business use cases for blockchain technology in the financial services sector.