The truth is that blockchain technology is already helping insurance companies to save time, improve transparency, save time, prevent fraud, comply with regulations and develop better products and markets.

According to the FBI, the cost of insurance fraud in the US is over $40 billion per year. The good news is that insurance companies could improve claims processes three times faster and five times cheaper using blockchain technology.

Blockchain technology is a distributed and decentralised public ledger, which is responsible for the powerful record-keeping technology behind Bitcoin.

With every blockchain transaction, insurance companies can tap into the rich deposits of resources to improve the way they do business.

Why the insurance industry is ready for a data revolution

How blockchain is being used in insurtech

In a survey of about 143 US insurers, which was conducted by the Property Casualty Insurers Association of American and FICO, “48% of insurers said that fraud accounts for 5-10% of their claims cost.”

Blockchain can help to fix these fraudulent claims and other problems using decentralised systems.

Let’s examine three use cases of blockchain in the insurtech industry:

1. Claim management

One effective way to ensure that submission and processing of claims are as secure, convenient and consumer-friendly as possible is leveraging blockchain.

Blockchain has the potential to seamlessly combine numerous data points from various sources (based on the location and analytics). When this happens, it can lead to a great reduction in the number of fraudulent claims.

Insurance companies can tap into a distributed blockchain ledger, which is responsible for distributing many streams of information and documents. This can include third-party reports, scene evidence, police comments, and so on.

Some of the vital steps when submitting claims can be completely automated. For example, an auto crash can quickly trigger a new claim initiation, while sending signals to the medical and/or mechanics support, everything happening at the same time.

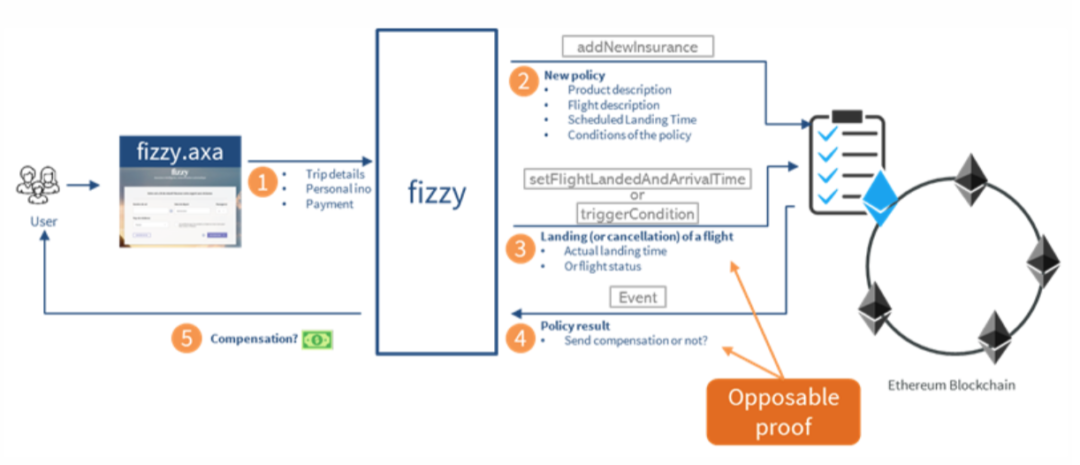

AXA Insurance, among others, has shown commercial interest in Blockchain adoption, by using it to offer claim-free flight insurance called Fizzy. This new technology is powerful — it mostly triggers a payment to the holder’s bank account when there’s a 2+ hour flight delay.

2. Reinsurance

Reinsurance is another delicate aspect of insurance. Blockchain can facilitate the ease of processing data as well as holding it a distributed ledger.

This will ensure that reinsurers receive verified real-time data without any form of adulteration due to third-party influence. Getting accurate real-time data is crucial, whether you’re investing in stocks or venturing into online investments.

In other words, they can receive data directly from the primary source, without having to involve their counterparties — insurers in this case.

Blockchain technology is also fostering faster and more efficient capital allocation — to help satisfy upcoming claims.

The merits are enormous, especially when you understand how insurance companies operate. In most cases, they deal with several reinsurers that may be interested in the same contract.

In this case, the reinsurers are expected to exchange the data readings between each other — thus, complicating operations and mounting pressures even more.

Blockchain technology offers a quick fix to this problem. Since it uses a shared ledger, the challenge of reconciling transactions for premiums and losses between the insurer and the reinsurers is minimised (or eliminated), because the system will always be up to date.

Based on several studies, blockchain has the potential to cut operational costs in half — by reinsuring the sector by $5-10 billion.

Savvy insurance operators such as Allianz, AIG, Aegon, and Swiss Re, are already embracing these blockchain innovations — having formed a strong consortium called B3i.

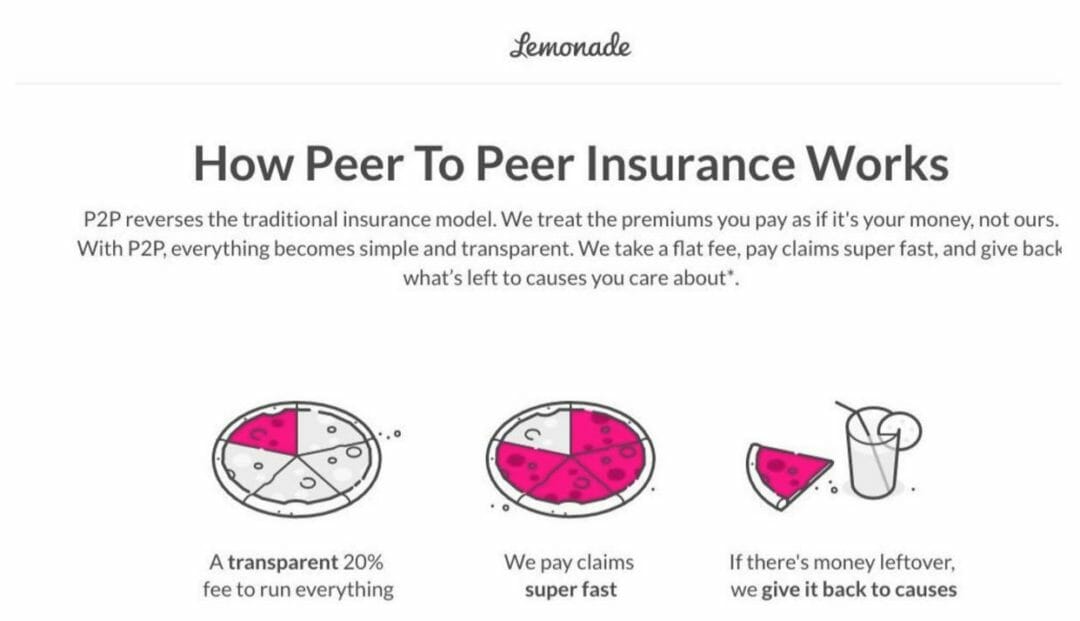

3. Peer-to-Peer Insurance

Peer-to-Peer Insurance (P2P Insurance) isn’t a new concept. It’s been in operation for a long time. However, Blockchain technology is inspiring insurers to embrace it wholeheartedly.

Truth be told, designing smart contracts that will facilitate the ease of damage reimbursement due to bad weather conditions that might damage properties, is one of the sole responsibilities of insurance companies.

These contracts are designed according to all manner of measurements, including weather readings and sensor data, as the case may be.

The goal is to make these claims less subjective and more reliable.

Today, smart contracts are truly ‘smart’ as they are now fully leveraged in peer-to-peer insurance marketplaces.

Blockchain has made this possible, ensuring that for these specific types of insurance entities, policyholders can collect higher premiums for the service as compared to the traditional insurance contracts.

Blockchain in Insurtech

The insurance industry is battling with a ton of operational inefficiencies ranging from complicated claims management, loads of paperwork that leads to poor customer experiences, and fraud.

Enter blockchain. A powerful decentralised system that provides stakeholders with the essential tools to boost operational efficiency.

It provides the digital means and hub for the smooth flow of data streams and transactions.

Written by Mohit Tater, CEO, Black Book Investments