HFS Research: Covid-19

The latest research from HFS looks at how enterprises and service providers are coping with the paradigm shift caused by Covid-19; asking the questions of what is actually going on and how is this unravelling.

Businesses have no choice but to adapt to this new environment if they want to retain any semblance of relevance for the times to come. So how fast are things evolving? How different is the new size and growth of IT and business services, and how will these take shape across technology, business process management, analytics, automation and AI?

The phases of response to Covid-19

In a webinar unveiling the research, the CEO and chief analyst at HFS Research, Phil Fersht, examined how organisation’s have responded to Covid-19.

Phase 1: Crisis — here leaders established work from home policies and initiated business continutiy planning. But, it was very much the case of planning day-to-day and week-to-week.

Businesses are now entering Phase 2: Stabilisation — the situation has exposed things that businesses can and can’t do. Now is the time to stay patient, because no one knows how long this situation will go on for and develop well thought out contingencies. In this phase, organisations should also get cash (know what’s available) and pivot for survival.

Phase 3: Realisation — Fersht described this phase as truly exciting. Beginning at the end of this month or the beginning of next “companies will begin to place their bets,” he said.

“The true financial impact to client and customers will emerge and then businesses should pivot again for emerging [successfully] in the post-Covid-19 environment. Different industries need to realise true plans for the future.”

The impact of the coronavirus on the UK tech sector: disruption ahead?

Short-termism

There is, however, an issue with organisation planning; while businesses are preparing for the next two-three months, most individuals feel that the current situation last four to 12 months.

“There is some short-termism going on. There needs to be realisation that this will take a while to unravel and return to normal,” continued Fersht.

The digital OneOffice

In this new environment, enterprises need to develop an experience architecture that brings together the customer, partner and employee to form the forward strategy; how to buy or sell in a remote model or how to anticipate the needs of a digitally native world, for example.

“There is a new duality of who is serving the customer and who is the customer,” said Fersht.

The OneOffice experience needs digital underbelly, intelligent support functions and predicitive digital insights to become an outcome driven front office that focuses on mobile and social interataction, touchless intratcion, real-time personalisation and customer-driven process design.

There needs to be an ongoing partnership between IT and business to drive these outcomes.

A business opportunity

According to the research, most enterprise clients are already feeling the need to change business priorities; 28% see emerging opportunities, 18% are hunkering down and rolling out cost saving measures, while 11% remain unclear in their approach.

The majority (82%) of initiatives focus on restructuring; moving workflow into remote environments, while there has been a 57% increase in designing new ways of operating in this envrionment to get ahead of competition — it represents an opportunity to change how enterprises do business and a reevaluate how they operate.

There has also been an acceleration in automation initiatives; 18% have experienced a major increase and 48% have felt some increase — there is an opportunity to automate to avoid disruption.

It’s a similar situation with AI investment with 48% of survey respondents experiencing some increase. Mainly, this has been the rollout of chatbots to take care of customer queries during these uncertain times. These are, by Fersht’s own admission, “simplistic and more sophisticated digital associates will need more time.”

Covid-19 and digitalisation: 4 areas of tech set to boom post-pandemic

Market forecasts and scenarios for IT and business services

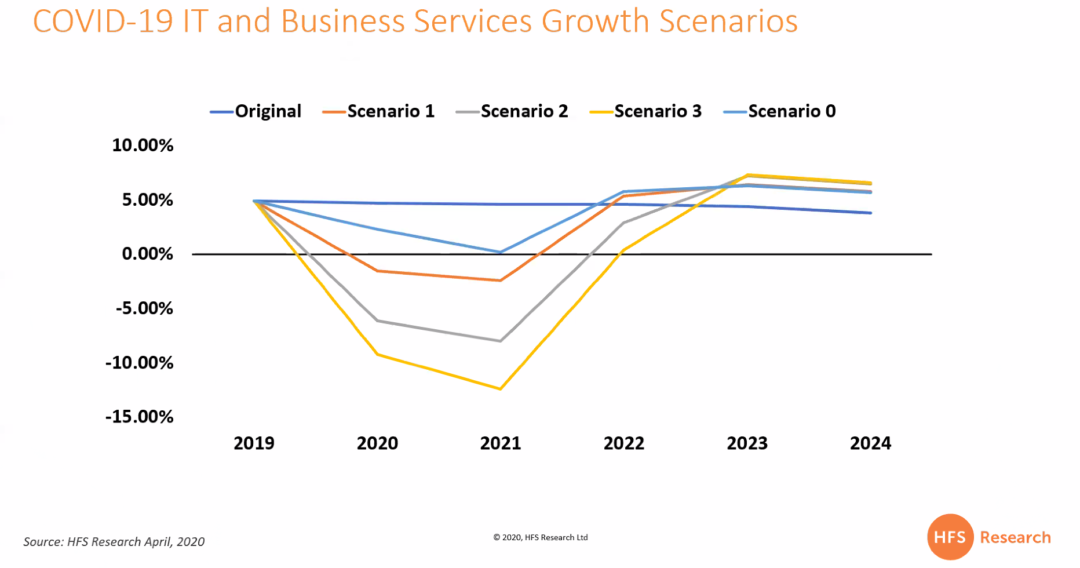

Jamie Snowden, chief data officer at HFS Research, examined the potential growth or stagnation for IT and business services.

He envisages three scenarios.

The first will follow a normal recession trajectory, which will be a continuation of market as we see it now.

The second will be similar to bad recession, like 2008 or Dot-com bubble, where major decisions are halted and there will be a major decline in professional services.

In the third scenario, businesses and society will continue to experience major additional disruption caused by social distancing/lockdown. Business will not be ‘as usual’.

The resurgence of Core IT

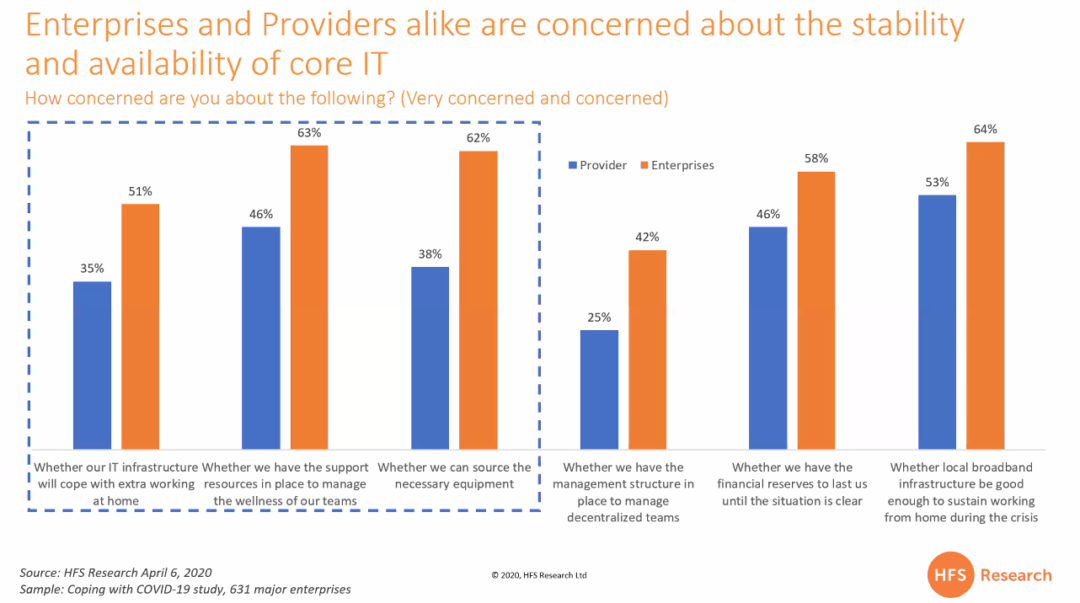

Currently, enterprises and providers are concerned about the stability and availability of Core IT. There are many providers competeing over same resources.

Ollie O’Donoghue, senior vice president, research at HFS, explained that this is now the priority; enabling a Core IT and management capability to provide staff with equipment, for example.

“Enterprises are also concerned about whether their network can support mass remote access,” he said.

Another Covid-19-related concern for organisations surrounds the ability to designate resources to support and monitor employee health as the virus continues to sweep through different populations.

“The culture shock that is hard to grapple with,” O’Donoghue continued.

According to the research, 45% of enterprises recognise the need to invest in IT and operations to support remote, decentralised teams, while most providers think they have what they need.

Although, 3% of providers need a great deal of additional investment in this area, compared to 1% of enterprises.

The majority of spend is going on laptops, collaboration software and security.

For providers; 85% are focusing on better conferencing and collaboration software, 71% on file sharing and online storage 71%, 71% on re-platforming applications for cloud and 73% on temporary SaaS to facilitate remote working.

There has also been a significant growth in cloud and cyber investments to support secure and easier accessibility, although “cloud maturity varies considerably by industry, some will be far from virtual nirvana,” said O’Donoghue.

What does this all mean? Core IT has reclaimed its rightful place as an essential asset.

Smart firms should focus on the immediate short-term IT solutions and then re-platform for this new environment. “If this reality becomes the new abnormal, the re-platforming [and re-strategising] for the long-term could become as important as short-term solutions,” he continued.

How can businesses manage technology costs during the Covid-19 crisis?

What’s going to happen with AI, automation and analytics?

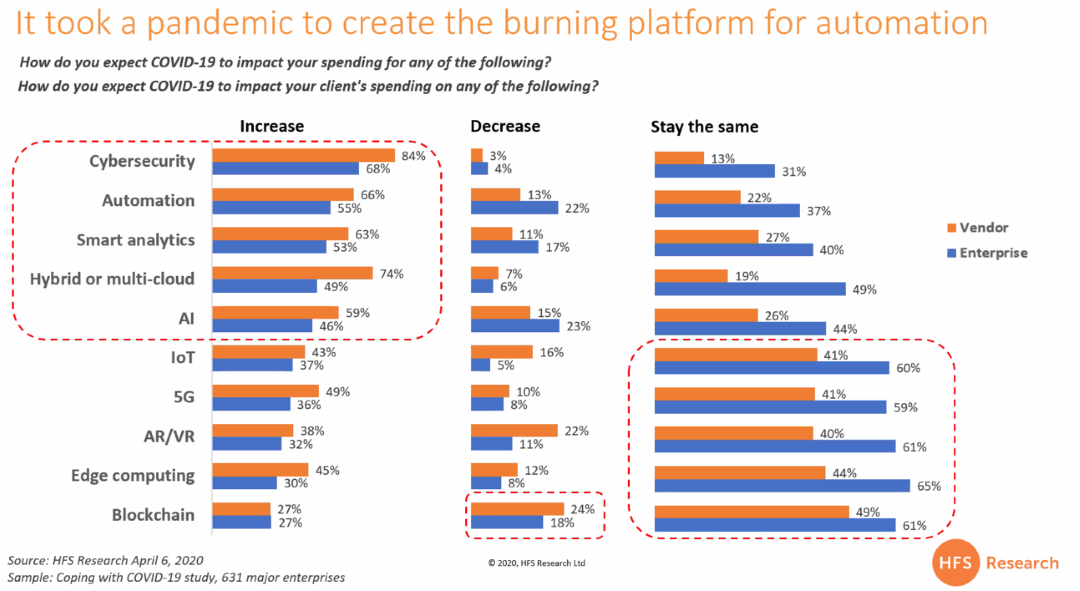

Automation has seen a lot of uptake, but scale has been a challenge. “It took this pandemic to create a burning platform for automation,” according to Eleanor Christopher, senior vice president, research at HFS.

The increase in uptake of automation, analytics and AI, because of the coronavirus, has been remarkable.

The need to transform has led to the need for integrated automation, which is the intersection between AI, automation and analytics, and people and processes.

The rebirth of BPM and the digital economy

Moving into the final area of the research, Saurabh Gupta, chief research officer at HFS, explained that “BPM services are expected to be hit the hardest and service providers searching for a surge in demand are likely to be disappointed.”

He continued: “In the post-Covid world, building a secure and resilient virtual human experience [will be essential]”.

Moving forward, Gupta advised enterprises and service providers to focus on farming existing business verses hunting for new business. “New opportunities will emerge off the back of this,” he said.

“Execute for today, plan for tomorrow and think about the day after by enabling a global work from home workforce for ongoing operations, and expect more vendor consolidation,” he added.

[emailsignup]