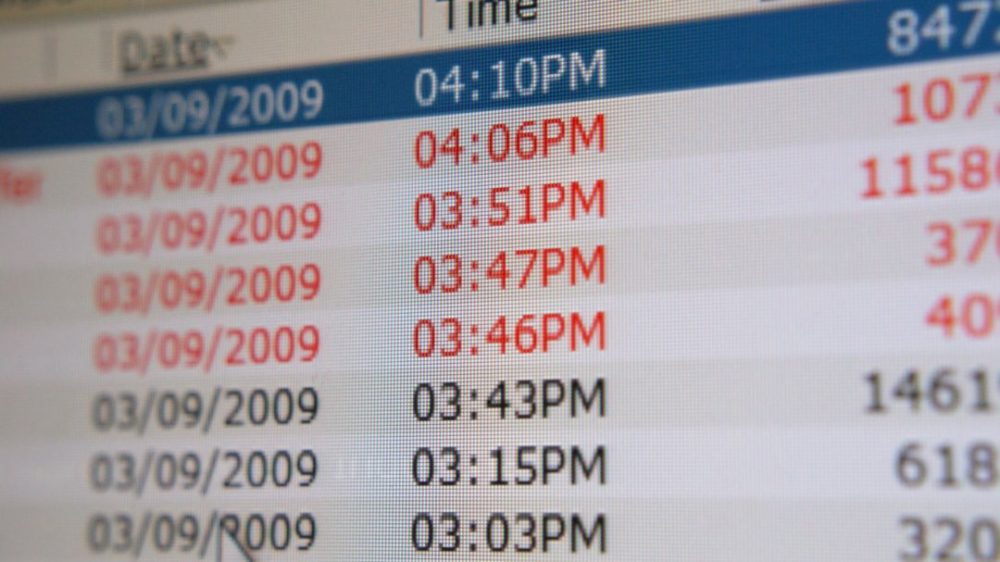

Detecting fraud has always been difficult for financial institutions.

It used to be the case that banks and firms could just hire more investigators, but as the methods of criminals continue to grow in sophistication, firms are now struggling to find efficient ways for to research cases.

Addressing the growing concern (and market), Oracle and Blue Prism have partnered to optimise and enhance financial crimes investigation workflows.

According to a spokesperson from Blue Prism, Blue Prism’s automation software further enables Oracle’s financial crimes software to deliver more comprehensive research and analysis, faster, more accurately and at a lower cost.

“Industries are being challenged on every side. Profit concerns, disruptive competitors, employee retention are all reasons Blue Prism has been successfully deployed across a variety of industries,” said Jon Walden, CTO, Americas for Blue Prism. “Our connected-RPA capabilities provide a unified workforce of both humans and digital workers to ‘get stuff done’. We’ve enjoyed great success in financial services industry because of the detailed audit and resiliency built into our platform. Some industries focus more on transactions to improve profit, some allow entrepreneurs in their organisation to tackle new challenges, regardless, Blue Prism frees up human capital to do more work.”

Don’t just check that box. What if regulatory compliance actually enhanced business innovation and performance

RPA: we take a look at UiPath, Blue Prism and Automation Anywhere