The partnership sees Barclays become the first high street bank in the UK to invest in Europe’s largest online invoice financing platform.

The deal will allow Barclays to offer its small and medium business clients a more enhanced cash flow management service.

>Read more on Automation – helping business overcome cash-flow challenges

“A number of our clients told us that they feel pressured into offering longer payment terms in order to stay competitive,” explained Barclays Business Bank CEO, Ian Rand. “This ties up their cash flow, preventing them from seizing growth opportunities.”

“Invoice financing gives small businesses the power to obtain funding in a fast and innovative way, and capitalise on those moments. Our corporate bank already offers invoice financing to large businesses, so it’s great news that we’re able to extend the proposition to work for our SME clients as well.”

SME clients of Barclays throughout the East Midlands, West Midlands, Hertfordshire and North West London are set to receive propositions regarding the bank’s new partnership, with a fully national roll-out of propositions expected to be launched in 2019.

“It’s exciting to be combining the knowledge and footprint of a 325-year old British banking institution with MarketInvoice’s tech-led online finance solutions,” said MarketInvoice CEO, Anil Stocker.

“Bringing this together in a strategic partnership can only mean good news for UK businesses, with the segment we’re targeting responsible for upwards of 60% of UK employment.”

“It’s easy to forget that the companies you see on the FTSE 100 all started as small businesses with founders following a passion. In focusing on the needs of these entrepreneurs through this collaboration, Barclays and MarketInvoice will truly transform the experience of UK companies in sourcing finance.”

>Read more on Unlocking the key issues affecting SME productivity

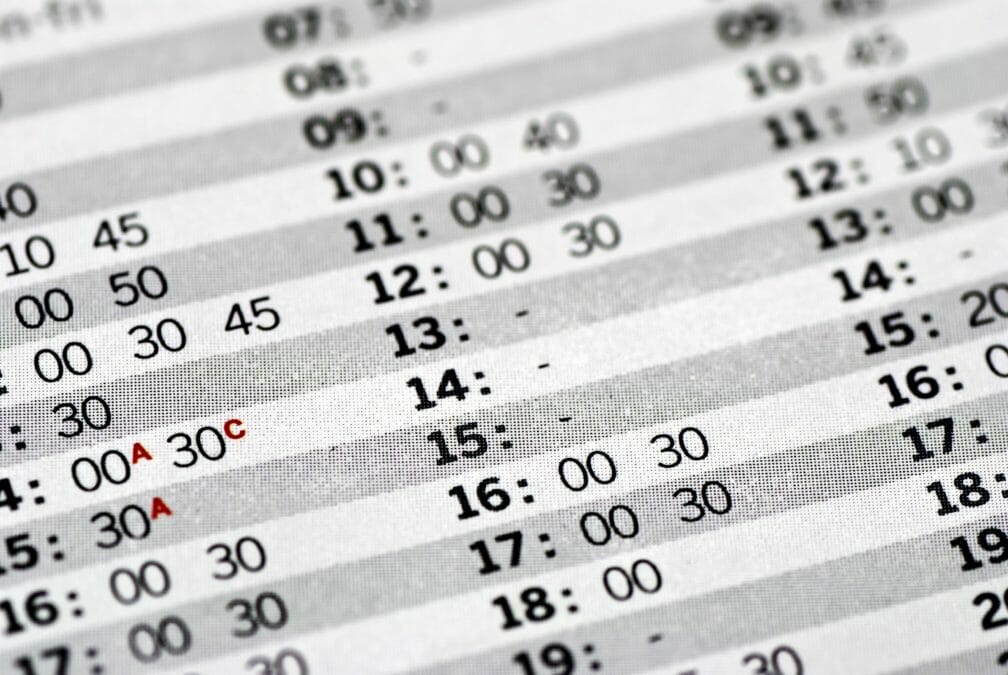

MarketInvoice, which was founded in 2011, has funded invoices worth more than £2.7 billion and designed for pay periods of up to 120 days.

As for Barclays, the bank recently doubled their unsecured lending for SME clients from £50,000 to £100,000, allowing qualifying clients to access up to £25,000 in pre-assessed lending.