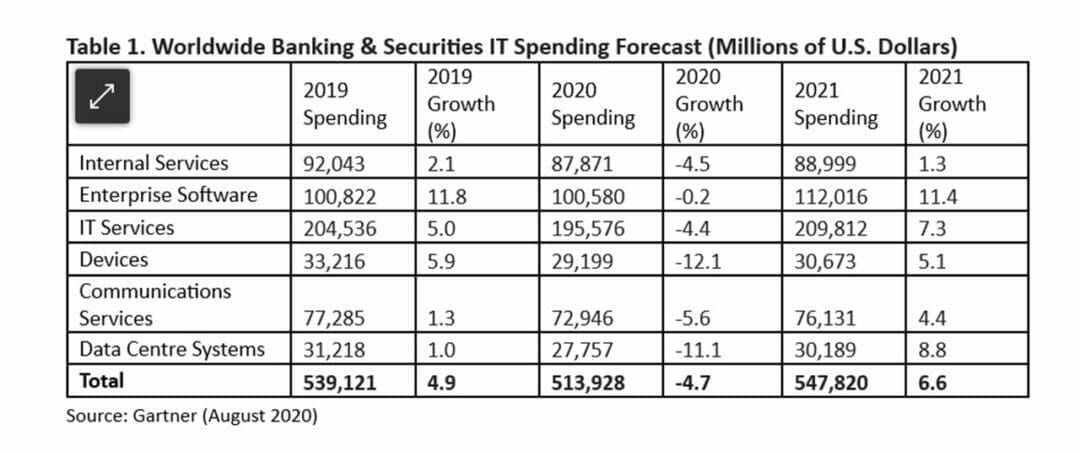

According to Gartner, spending on devices within banking and securities, such as PCs and mobile devices, will see the biggest decline (12.1%), followed by data centre systems (11.1%).

IT services, meanwhile, is also predicted to decline, following growth of 5% in 2019, as contract size and terms, as well as deal types, are set to be severely impacted, and large transformation projects curtailed or cancelled.

Q&A: Iron Mountain CTO discusses transformation during Covid-19

However, it’s predicted that new sources of revenue, such as digital engagement services, will be critical to extended recovery, despite restrictions, and the forecast projects the industry to recover in 2021, with growth of 6.6%.

“Covid-19 has not only caused uncertainty within the banking and securities industry this year, but also a defined shift in the way customers must interact with their financial institutions,” said Jeff Casey, senior director analyst at Gartner. “These firms continue to respond to the emerging needs of customers amid ongoing economic closure and dwindling government support.

“With a better understanding of the impact of Covid-19, banks and securities firms are now accelerating automation initiatives, such as customer-facing chatbots, robotic process automation (RPA) and end-to-end account origination solutions.

“They’re also focused on redesigning organisation structures and workflows, and reprioritising modernisation initiatives.”

During the early stages of the pandemic, IT spending within banking and securities was found to be focused on four key areas:

- Operations: ensuring continued access to basic services;

- Supply chain: addressing emerging supplier and customer needs;

- Revenue: ensuring continued business viability;

- Workforce: Supporting employees working from home.