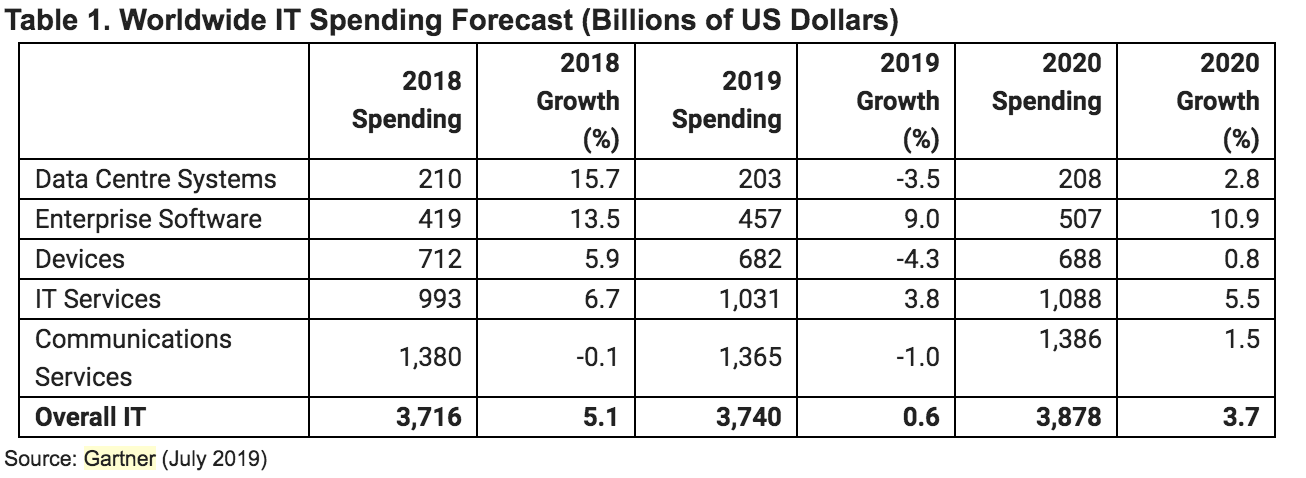

Worldwide IT spending is projected to total $3.74tn in 2019, an increase of 0.6% from 2018, according to the latest forecast by Gartner, Inc.

This is slightly down from the previous quarter’s forecast of 1.1% growth.

“Despite uncertainty fuelled by recession rumours, Brexit, trade wars and tariffs, we expect IT spending to remain flat in 2019,” said John-David Lovelock, research vice president at Gartner. “While there is great variation in growth rates at the country level, virtually all countries tracked by Gartner will see growth in 2019. Despite the ongoing tariff war, North America IT spending is forecast to grow 3.7% in 2019 and IT spending in China is expected to grow 2.8%.”

According to Gartner, although an economic turndown is unlikely for either 2019 or 2020, the risk is currently high enough to warrant preparation and planning.

Gartner: debunking five artificial intelligence misconceptions

“Technology general managers and product managers should plan out product mix and operational models that will optimally position product portfolios in a downturn should one occur,” added Mr Lovelock.

The enterprise software market will experience the strongest growth in 2019, reaching $457bn, up 9% from $419bn in 2018. CIOs are continuing to rebalance their technology portfolios, shifting investments from on-premises to off-premises capabilities.

Gartner’s research claims that cloud will continue growing over the next few years and will influence ever-greater portions of enterprise IT decisions, in particular, system infrastructure. Prior to 2018, more of the cloud opportunity had been in application software and business process outsourcing. Over this forecast period, it will expand to cover additional application software segments, including office suites, content services and collaboration services. “Spending in old technology segments, like data centres, will only continue to be dropped,” said Mr Lovelock.

Server migration and management in the enterprise

Globally, consumer spending as a percentage of total spend is dropping every year in every region due to saturation and commoditisation, especially with PCs, laptops and tablet devices. Cloud applications allow these devices to have an extended life, with less powerful equipment needed to run new software. This is why the devices market will experience the strongest decline in 2019, down 4.3% to $682bn in 2019.

“There are hardly any ‘new’ buyers in the devices market, meaning that the market is now being driven by replacements and upgrades,” said Mr Lovelock. “Add in their extended lifetimes along with the introduction of smart home technologies and IoT, and consumer technology spending only continues to drop.”