Following the announcement that the UK will allow Huawei to help build its 5G network, how soon will the technology come into play and what are the revenue opportunties?

At this year’s Mobile World Congress (MWC) in Barcelona, 5G was presented to the world in a variety of forms — physical devices (even a foldable 5G phone!), snazzy experiential demos, innovative network and base station solutions and countless keynotes on the potential use cases for businesses and consumers.

5G UK

In the UK, operators are also making headway when it comes to infrastructure. Earlier this year, O2 pledged to roll out 5G in the four UK capital cities — London, Edinburgh, Belfast and Cardiff — by late 2019. EE, Three and Vodafone have confirmed similar plans with a similar timeline.

The EU recently requested that each of its 28 members undertake an urgent risk assessment of their 5G networks and suppliers.

The findings are to feed into the creation of a pan-European security standard for 5G, which will come into fruition in just over a year. While this is a response to growing security fears around Chinese telecommunications vendors, it also shows how far Europe is on the road to making 5G a reality.

Despite the vast amount of work being done in this area, few people can foresee exactly how 5G is going to play out and what it will look like. The opportunities for innovation and revenue growth are massive, but there are still concerns about the economics of providing widespread 5G connectivity and driving mass adoption. These concerns are valid. The jump from 4G to 5G will be the most significant to date, costing UK operators a pretty penny that they will — understandably — be eager to recoup quickly.

With the UK’s 5G infrastructure soon to be firmly in place, these same operators must look to their peers in other regions and digital companies in other sectors to understand how they can monetise this new infrastructure.

So, what might those revenue opportunities look like? Here are four 5G applications that UK operators should be preparing for today.

The age of 5G: what to expect with next-generation wireless

1. IoT

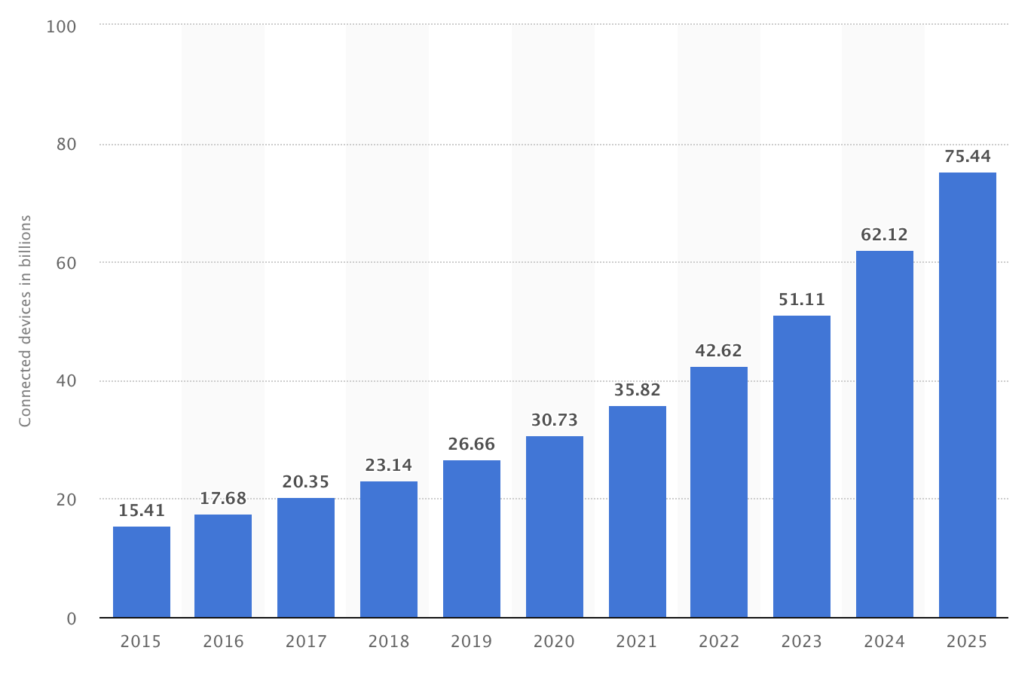

Over the last decade, the explosion of smartphones and the emergence of other connected devices (Smart TVs, Fitbits, and iPads) have changed the way we work and play. And yet, this is just a small sliver of what is to come.

By 2025, Statista expects a whopping 75 billion devices to be connected worldwide — this is a 200% increase on today. 5G will be fundamental to this change, it will completely reshape how all sorts of devices communicate with each other and their surroundings.

Take the manufacturing industry, for example. Many manufacturers are already making efficiency gains by increasing automation and enabling more data exchange within their existing processes. 5G will continue to play a significant role in this transformation of the manufacturing industry, particularly around augmented reality (AR) and virtual reality (VR) technologies.

UK operators have an opportunity here to take the technological lead on the emerging use cases that require higher bandwidth and business critical connectivity within sectors like manufacturing, positioning their 5G networks as the key enabler to enterprises’ desired success-based outcomes. They should partner with manufacturers to help tackle the problems that 5G can solve and deliver this as a service across the sector.

In the retail world, IoT-enabled shopping experiences are gaining traction. One example is pioneering facial recognition technology helping to streamline and enhance the in-store experience, while also providing improved security capabilities to the retailer. Applications like this require high levels of interconnectedness, which will only be improved by the widespread availability of 5G. Again, operators can use this to position themselves as a key partner for retail businesses looking to push boundaries and grow revenues.

The beginning of 5G in the workplace: The transformational impact and the challenges

2. Sport and entertainment

Sports and media audiences will enjoy an augmented viewing experience thanks to 5G. VR and AR technologies — coupled with 5G-enabled ultra-high-fidelity — is set to dramatically alter how fans interact with entertainment and sports events, whether they’re being watched live and in-person at a venue, or through a screen. There is already plenty of buzz within these industries around 5G’s potential to combine with other technologies and transform the way fans experience sport and entertainment — and the potential revenue this will generate.

But this is not simply a connectivity question. UK operators and communication service providers can drive revenue by partnering with broadcasters and sporting rights holders to create value-add services which consumers will access through dedicated self-service applications.

3. Fixed wireless access

Even in developed countries such as the UK, connectivity is not a “solved problem” in all areas. Geographic and commercial reasons exist to explain why connectivity infrastructure is not deployed and high-speed internet is not delivered in all areas.

Fixed wireless access will bring high bandwidth digital services to rural, temporary “pop-up” sites, and other underserved areas anywhere in the world. This will mean that mobile network operators will be in competition with wireline, satellite and cable companies — creating a new revenue stream with lower cost and delivering faster time to ROI.

The state of 5G deployments in 2019

4. Autonomous vehicles

There is ongoing debate at the European Commission level that 5G might not be an absolutely necessary component for autonomous vehicles (AVs). However, one thing that is certain is that 5G, when available, can deliver the bandwidth speeds needed to transfer data to and from autonomous vehicles and their environment. This would enable AVs to communicate with other vehicles on the road to share information, improve safety and interpret their surroundings — for example, by communicating with a stop sign to ensure that the vehicle comes to a halt.

Clearly these use cases are compelling, but with recent suggestions that a widespread launch of AVs will happen later than expected, there is probably no revenue opportunity here in the short term – so network operators need to look at longer term ambitions here.

Collaborate to win

5G will move the needle for the mobile industry and will revolutionise many other industries too. For telcos, it’s a huge opportunity to implement cooperation-based models to capitalise on the full spectrum of commercial opportunities.

Network sharing options and spectrum farming should represent great optimisation opportunities for mobile operators, but it’s vital that the mobile ecosystem as a whole fully appreciates the limitations associated with frequency allocation, network investment, regulatory restrictions and the availability of funds for investment.

But the mobile industry can’t do this alone. It will require the support of, and cooperation with, other parties including government, network hardware manufacturers and vertical solution providers, forming a coalition which can work together to identify commercially viable and desirable customer solutions.

This has to happen for the full potential of 5G to be realised, for a true paradigm shift to be delivered, and major new revenue opportunities uncovered and exploited. Outside of the telecoms space, plenty of other industries will be watching very closely.