5G has dominated headlines of late, for both positive and negative reasons. Questions have been asked over its feasibility and some network infrastructure providers have come under severe scrutiny for rumoured trust and security vulnerabilities. But, regardless of these conflicts, it’s clear 5G’s future is bright. The next generation network will have a transformational impact on business and society, once the right use cases are identified — in Singapore, for example, one such case study surrounds using 5G to transform the nation’s ports into smart, connected entities. We’re in the test phase of 5G now and in 2020 and beyond, the technology will steal the show.

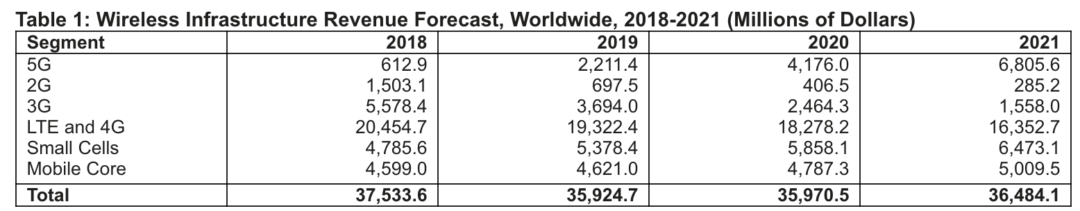

This potential is reflected in Garter’s latest forecast. It predicts that in 2020, worldwide 5G wireless network infrastructure revenue will reach $4.2 billion. This represents an 89% increase from 2019 revenue of $2.2 billion.

Additionally, Gartner forecasts that investments in 5G NR (new radio) network infrastructure will account for 6% of the total wireless infrastructure revenue of communications service providers (CSPs) in 2019, and that this figure will reach 12% in 2020 (see Table 1).

5G use cases: important for acceptance of the new digital infrastructure

“5G wireless network infrastructure revenue will nearly double between 2019 and 2020,” said Sylvain Fabre, senior research director at Gartner. “For 5G deployments in 2019, CSPs are using non-stand-alone technology. This enables them to introduce 5G services that run more quickly, as 5G New Radio (NR) equipment can be rolled out alongside existing 4G core network infrastructure.”

In 2020, CSPs will roll out stand-alone 5G technology, which will require 5G NR equipment and a 5G core network. This will lower costs for CSPs and improve performance for users.

5G rollout will accelerate

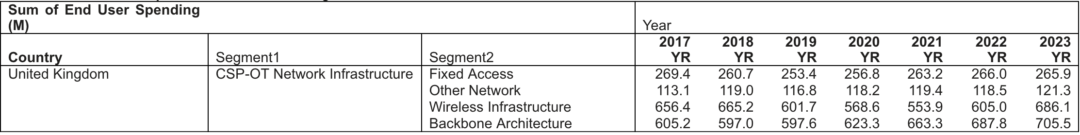

5G services have already launched in many major cities, including the US, South Korea and some European countries, including Switzerland, Finland. And this trend will accelerate next year — UK CSPs in Canada, France, Germany, Hong Kong, Spain, Sweden, Qatar and the United Arab Emirates have announced plans to accelerate 5G network building through 2020.

As a result, Gartner estimates that 7% of CSPs worldwide have already deployed 5G infrastructure in their networks.

Why 5G is the heart of Industry 4.0

5G for the enterprise — the real value

At the moment, consumers represent the main segment driving 5G development, but CSPs will increasingly aim 5G services at enterprises — where the real value resides.

5G networks are expected to expand the mobile ecosystem to cover new industries, such as the smart factory like what’s planned in Singapore, autonomous transportation, remote healthcare, agriculture and retail sectors, as well as enable private networks for industrial users.

Equipment vendors view private networks for industrial users as a market segment with significant potential. “It’s still early days for the 5G private-network opportunity, but vendors, regulators and standards bodies have preparations in place,” said Fabre.

But, preparations are underway. Germany has set aside the 3.7GHz band for private networks, and Japan is reserving the 4.5GHz and 28GHz for the same. Ericsson aims to deliver solutions via CSPs in order to build private networks with high levels of reliability and performance and secure communications, while Nokia has developed a portfolio to enable large industrial organisations to invest directly in their own private networks.

“National 5G coverage will not occur as quickly as with past generations of wireless infrastructure,” added Fabre. “To maintain average performance standards as 5G is built out, CSPs will need to undertake targeted strategic improvements to their 4G legacy layer, by upgrading 4G infrastructure around 5G areas of coverage. A less robust 4G legacy layer adjoining 5G cells could lead to real or perceived performance issues as users move from 5G to 4G/LTE Advanced Pro. This issue will be most pronounced from 2019 through 2021, a period when 5G coverage will be focused on hot spots and areas of high population density.”

Related articles

5G and IoT – how to deal with data expansion as you scale

5G in the UK — overhyped or has the next era of connectivity really begun?

5 reasons why 5G is the future

The state of 5G deployments in 2019

The road to making 5G a reality in the UK – and the revenue opportunities

Achieving a connected, digital future in the Asia-Pacific region